Understanding Real Estate Fractional Investment with RealVantage

The real estate market has long been a bastion for solid investment opportunities, but traditionally, it required significant capital, limiting access to a select few.

Introduction

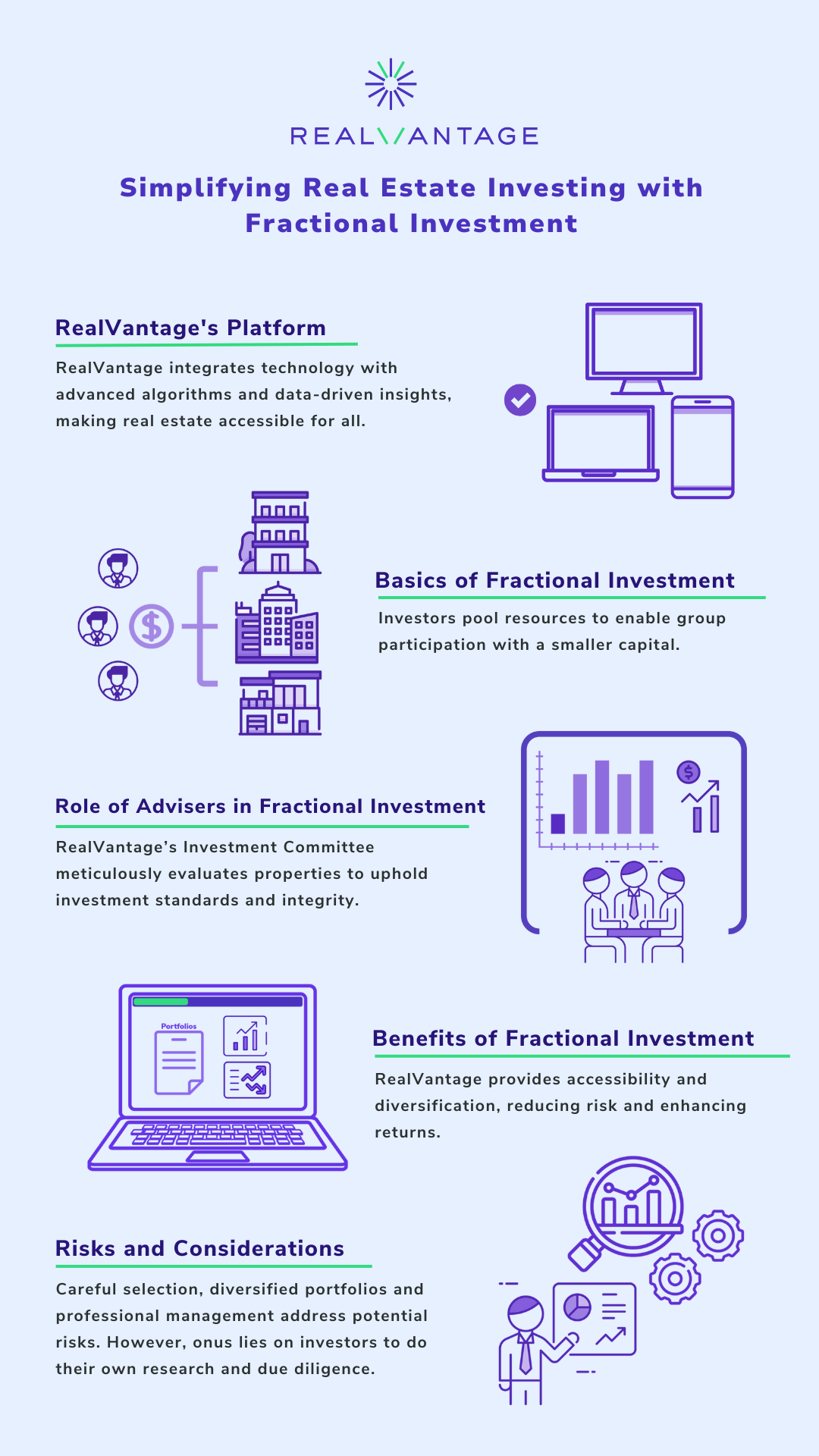

The real estate market has long been a bastion for solid investment opportunities, but traditionally, it required significant capital, limiting access to a select few. However, the emergence of fractional investment is revolutionising this landscape, making real estate investment more accessible than ever before. This approach breaks down high-value property investments into smaller, more affordable shares, allowing individual investors to participate in the real estate market without the substantial initial capital.

RealVantage’s platform is at the forefront of this transformation. The platform seamlessly integrates technology with perspectives, providing individual investors with opportunities for diversification in real estate investment, at a fraction of the capital required. By leveraging technology and innovative investment models, RealVantage is democratising access to real estate investments, offering a blend of opportunity, accessibility, and diversity previously unavailable to the average investor.

1) The Basics of Real Estate Fractional Investment

Fractional real estate investing is where multiple investors pool their resources to purchase shares in property assets. Unlike traditional real estate investment, which often requires a significant upfront investment, fractional investment allows individuals to own a part of the property with a much smaller outlay. This approach not only lowers the entry barrier to real property investment but also reduces the risk associated with investing large sums in a single property.

Traditional real estate investments typically involve buying a whole property either for rental income or capital appreciation. In contrast, fractional ownership allows investors to diversify their investment across multiple properties and types of real estate. The growing popularity of this model lies in its accessibility, affordability, and the opportunity for diversification it offers, making it an attractive option for a broader range of investors.

2) How Fractional Investment Works

The process of fractional investment begins with the selection of a property by the investment platform. The property's value is then divided into smaller, more affordable shares that individual investors can purchase. Investors own a fraction of the property proportionate to their investment and receive returns based on the property's rental income or capital appreciation.

Technology plays a critical role in facilitating fractional ownership. It is also an online platform which offers investors transparency and control over their investments. For instance, an investor might choose to invest in a commercial property in a prime location, buying a share worth a few thousand dollars – a fraction of the property's total value.

3) RealVantage's Approach to Fractional Investment

RealVantage stands out in the fractional investment property market through its unique approach. The platform carefully curates real estate opportunities, focusing on properties with strong growth or income potential. It evaluates factors like location, market trends, and economic indicators to select investments that offer the best potential returns for its investors. Moreover, RealVantage distinguishes itself by providing exclusive access to private equity for real estate, allowing investors to engage in high-value opportunities that contribute to their overall portfolio strategy.

RealVantage offers a seamless investment experience. Investors on the platform can browse various investment opportunities, each with detailed information and analysis to help them make informed decisions. RealVantage also offers access to institutional-grade properties, differentiating itself in the fractional investment market.

4) Benefits of Fractional Investment through RealVantage

One of the primary benefits of investing through RealVantage is accessibility. The platform enables individual investors to venture in real estate markets with a relatively small amount of capital. This democratises access to property investment, historically the purview of wealthy individuals or institutional investors in the dynamic landscape of real estate investment.

RealVantage also offers extensive diversification opportunities. Investors can spread their capital across different types of properties (residential, commercial, industrial) and various geographical locations. This diversification can potentially reduce risk and enhance returns. Moreover, RealVantage's management team brings a wealth of experience, offering professional insights and strategies that individual investors might not have access to otherwise.

5) Risks and Considerations

While fractional investment opens up new opportunities, it's not without its risks. Market volatility, property value fluctuations, and economic changes can affect real estate investments. Additionally, liquidity can be a concern, as selling a fractional share in a property might not be as straightforward as selling stocks or bonds.

RealVantage addresses these risks through careful property selection, diversified portfolios, and professional management. However, investors should still perform their due diligence. They need to understand the market dynamics, assess their risk tolerance, and consider how fractional real estate investment fits into their overall investment strategy.

6) The Future of Fractional Real Estate Investment

The future of fractional real estate investment looks promising, with technology continuing to break down barriers and open up new opportunities. Trends indicate a growing interest in diverse property types and international markets, expanding the potential for innovative investment strategies.

RealVantage’s ability to leverage data, provide market insights, and offer a diverse range of investment opportunities meet the evolving needs of modern investors. The growth of fractional investment could significantly impact the real estate industry, making it more dynamic, accessible, and inclusive.

Conclusion

Fractional real estate investment represents a significant shift on how individuals can engage with property markets. It offers a blend of accessibility, diversity, and potential for returns, making it an attractive option for a wide range of investors. RealVantage provides the tools, expertise, and opportunities necessary to make the most of this investment model. As the sector continues to evolve, it holds the promise of democratising real estate investment, allowing more people to participate in and benefit from the property market.

Frequently Asked Questions

What is fractional real estate investment, and how does it differ from traditional real estate investment?

Fractional real estate investment involves multiple investors pooling resources to purchase shares in property assets. Unlike traditional investment, it allows individuals to own a portion of a property with a smaller capital outlay, providing accessibility and reducing risk.

How does RealVantage's platform enhance accessibility for individual investors in real estate markets, particularly in Singapore?

RealVantage's platform leverages technology to break down barriers, allowing individual investors to engage in real estate with a fraction of the capital traditionally required. This democratisation of access is especially significant in the dynamic landscape of real estate investment in Singapore.

What unique features does RealVantage offer to enhance the benefits of fractional real estate investment, and how does it empower investors to make informed decisions?

RealVantage distincts itself by providing exclusive access to private equity for real estate, offering investors high-value opportunities for portfolio enhancement. Additionally, the platform's co-investment opportunities, along with access to institutional-grade properties, contribute to a robust and informed investment experience.

Understanding Real Estate Fractional Investment with RealVantage

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.