The Capital Stack - and How It Affects Your Investments

Not sure how each type of capital stack will affect your investment? Identify and understand the risks and rewards to make a well-informed decision.

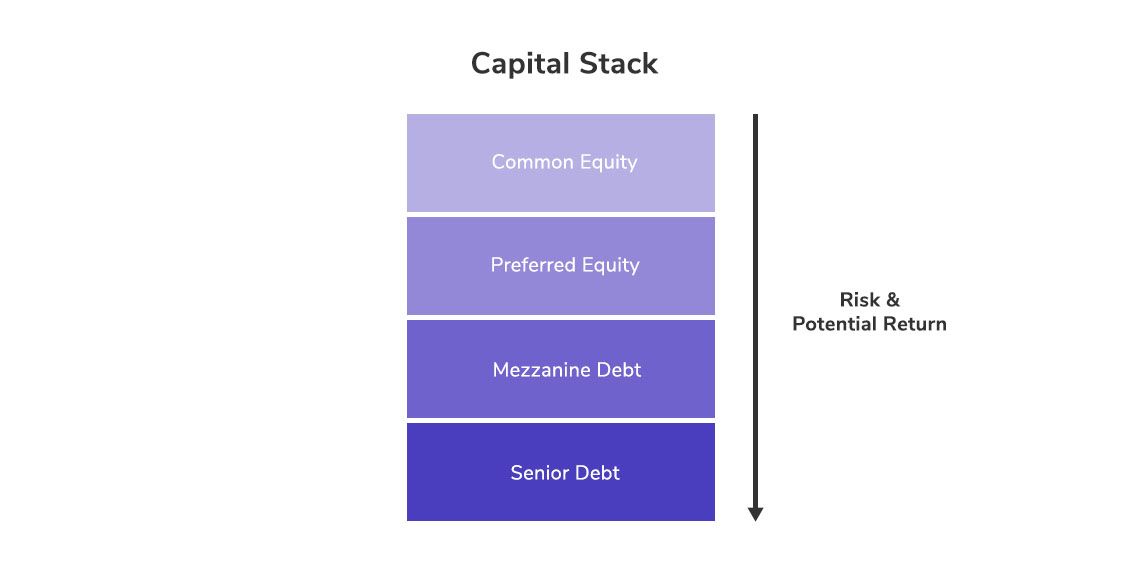

In the world of investments, risk and return profiles can vary not just between asset classes but also within an individual project. One way this is illustrated in real estate investments is through the ‘capital stack’. The capital stack showcases the sources of funding used to purchase and finance the property. There can be many different layers to a capital stack, with the most common ones being – Common equity; Preferred equity; Mezzanine debt; and Senior debt. More complicated capital structures may contain hybrid securities that display traits of both equity and debt, such as convertible debt.

As an investor moves down the capital stack, both risks and returns become lower. The lower risk is attributed to higher seniority and priority of claims on cash flows generated by the asset enjoyed by the bottom capital stacks (i.e. senior debt & mezzanine debt). For instance, in the event of liquidation or refinancing, senior debt-holders will have first-claim on the remaining value of the underlying property, followed by mezzanine debt-holders, preferred equity investors, and finally common equity investors.

Each capital stack is subordinated to the stack below them. Any cash flow generated by the underlying property will pay off debt-holders first before it reaches equity investors. In circumstances where the property does not generate sufficient cash flows to cover the fixed debt payments, the equity stacks will be obliged to cover the shortfall. If the poor performance persists, equity investors will continue to make the payments till they can no longer afford to and enter into default.

So why would investors be willing to put their money in higher-risk capital stacks (i.e. common equity & preferred equity)? The answer: greater potential returns. While the highly secured segments of the capital stack are protected and have guaranteed payments, they are not entitled to the additional returns that a high performing property may generate. Meanwhile, equity investors are able to reap the upside rewards of an outperforming property, which compensates them for undertaking higher risks.

Read also: An Overview of Institutional Investors

Read also: What is an Accredited Investor?

It should be clear by now that for equity and debt investors, they need to appreciate the implications of other segments of the capital stack on their investment. For equity investors, the risks associated with taking on debt need to be balanced against the prospects of boosting returns through leverage. For debt investors, beyond just focusing on the sufficiency of the debt coverage from the asset’s income, they need to thoroughly understand how the debt will be eventually repaid. Fundamentally, one has to ensure the asset’s value is more than sufficient to cover all senior and mezzanine debts in the capital stake.

There are clear benefits and costs tied to each capital stack. The ability to identify and understand how the factors fit a particular risk profile and investment objective is paramount in making well-informed investment decisions. RealVantage does not attempt to classify one capital stack as superior to another, but rather to empower investors with the knowledge to make educated investment decisions.

For more insights:

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.