Diversify Your Investments Through Real Estate

In this article, you will understand the concept of diversification and why it is a commonly used investment strategy among investors.

Diversification is a commonly used investment strategy, whereby an investor’s investment portfolio is spread across many different types of assets. The aim of diversification is to spread out investment risk across different asset classes, sectors, and strategies, so that underperformance in one particular asset will have a lower impact on the overall performance of your entire investment portfolio.

Examples of different asset classes are stocks, bonds, exchange-traded funds, and real estate. An investor can further diversify within each asset class, for example for real estate, an investor can invest across various geographical markets, investment strategies, and property types.

Why diversification is important for your investments

Diversification is a key part of investing as it reduces the volatility and risk of loss in an investment portfolio over the long run. Having a diversified investment portfolio generally generates higher risk-adjusted returns in the long run, compared to a non-diversified portfolio, and is perhaps the most important way to attain your long-term financial goals while mitigating risk.

Diversifying your investment portfolio with real estate

Real estate provides investors with an ideal opportunity to diversify their assets, due to the asset class’s low correlation with conventional equity and bond investments. Furthermore, there are several ways through which assets can be diversified within real estate, namely: by sector; geography; or strategy.

Research published in the Journal of Real Estate Research has shown that adding real estate in a mixed-asset portfolio makes it possible to reduce portfolio risk by 10% to 20% and that the optimal allocation to real estate is in the 15% to 25% range.

How to diversify within real estate investments

Diversifying by sectors (residential, industrial and commercial)

Residential properties

Residential properties refer to any property used for residential purposes and can range from a single unit or house to large apartment complexes. Residential real estate has a relatively stable demand, due to the need for housing.

Single-family residential properties and multifamily residential properties, such as duplexes, triplexes and fourplexes, are smaller types of residential real estate that can still generate significant returns for investors. However, investors who have more funds can look into larger residential real estate options, such as apartment complexes or condominiums.

Residential property investment typically involves renting out the property to generate rental income from tenants. However, investors should conduct their research and ensure that the property has enough demand to generate rental revenue.

Residential properties do have a degree of risk involved, since they tend to have shorter leases than industrial or commercial properties, averaging about 12 months.

Read Also: Investing in Australian Residential Real Estate

Industrial properties

Industrial real estate refers to any property that is used for industrial purposes, such as manufacturing, distribution, storage and production. These properties include factories, warehouses, and data centres.

Industrial properties typically have longer leases than residential properties, since industrial tenants are more willing to agree to longer leases of up to 10 years; this increases the security of the investment for investors. These leases also tend to be net leases, where the tenants cover some of the property expenses.

Industrial properties tend to be larger and require higher upfront capital investments, making them less accessible to individual investors. However, the higher rental rates associated with industrial properties means that they also have the potential for higher yields, typically around double of which residential properties can generate.

Commercial properties

Commercial real estate refers to real estate that is used mainly for commercial or business purposes. Some examples of commercial properties include office buildings and shopping malls.

Commercial properties typically have a higher income returns, compared to residential properties, with yields ranging typically between 5% and 10%. Leases for commercial properties also tend to be longer than residential properties, with an average period of 3 to 5 years. Commercial properties also tend to use net leases such as double net leases or triple net leases instead of gross leases.

Diversifying by geographies (city, countries and region)

The market in which a property is located can also have an impact on an investment portfolio’s diversification. Market selection holds high potential for diversification and is an important part of the real estate investment process.

Read Also: Market Selection in Real Estate - RealVantage’s Approach

Institutional investors tend to seek out risk-adjusted returns on their investments, with a focus on diversifying their portfolio. Therefore, most of these investors tend to invest across different markets to avoid concentration risk.

Smaller markets offers less potential for diversification, while deeper markets have higher potential for diversification, even within a single country or city. For example, an investor can further diversify his or her real estate investments by investing across different countries, different cities within that same country and different regions within the same city.

By diversifying real estate investment through different markets, investors can lessen the overall impact on their investment portfolio returns in the event a particular market performs poorly.

Diversifying by strategies (Core, Value-Add and Opportunistic)

Core strategy

A Core real estate investment typically holds lower risk, as they are usually in good condition and have low vacancy rates, generating stable cash flows for investors. Properties of a Core investment strategy usually follow a buy-and-hold model, whereby the property is bought and held to generate returns in the form of rental income, rather than focusing on capital appreciation.

Value-Add strategy

A Value-Add real estate investment is typically higher in risk, compared to core investments, since the property tends to be performing below its potential and requires physical upgrades, such as renovations or maintenance to improve the quality of the property. The property may also require a change of property managers, if it is holding back the property’s performance.

After value has been added to a property, it can then be marketed as an upgraded property and leased out at a higher rent. While this strategy entails more work than the Core strategy, it has the potential to generate significant returns for the investor through rental income, as well as the appreciation in the property’s value.

Opportunistic strategy

Opportunistic real estate investments take advantage of underperforming properties, which are generally acquired at a lower cost, such as distressed assets or undeveloped land. The existing property may require significant renovations, additions and alterations works (A&A), or a complete redevelopment to maximise returns. This strategy involves “flipping” the property, where an investor acquires the property at a lower price, adds value to the property, and then sells it for a significantly higher price. Opportunistic investments also include greenfield development deals, where an investor would purchase an undeveloped plot of land and develop a building on it based on market demand.

Since most of the returns on a property using the Opportunistic strategy are generated through capital appreciation, investors will typically be able to obtain an internal rate of return of more than 15%, although the risk of investing in an opportunistic property is also correspondingly higher.

Read Also: The Real Estate Risk/Reward Spectrum & Investment Strategies

Specialisation versus diversification

Specialisation is an investment strategy that is the direct opposite of diversification. Investors who adopt this strategy typically focus on a particular asset type, using a proven strategy, with the hope of achieving repeated successes in their investments. In real estate investment, this typically means that investors would invest in a particular property type using the same strategy for all their investments, and specialising in that particular area of investment.

However, specialisation holds a significantly higher risk than diversification, since a downturn in the specialised investment market may lead to losses throughout the entire specialised investment portfolio.

Diversification protects investors from this risk, meaning that a loss in one investment within an investment portfolio will be less likely to lead to a net loss for the overall portfolio. However, both specialisation and diversification have their advantages and disadvantages. Investors should consider what they want out of their own investment portfolio and select their investments accordingly.

A sample basket of real estate investments

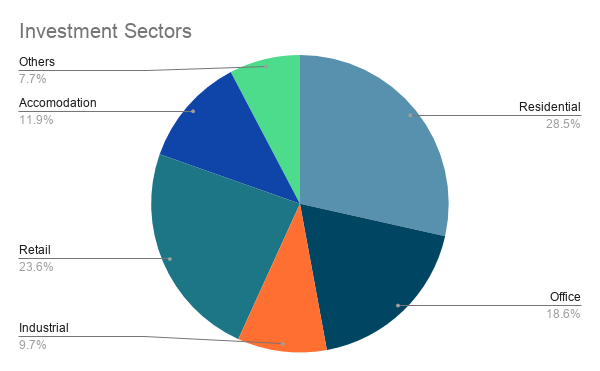

Example of diversified real estate investment allocations across sectors

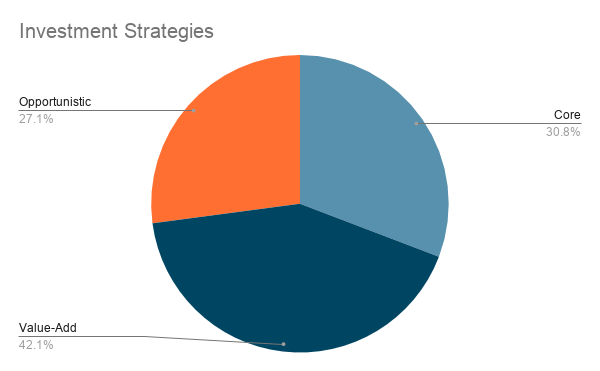

Example of diversified real estate investment allocations across strategies

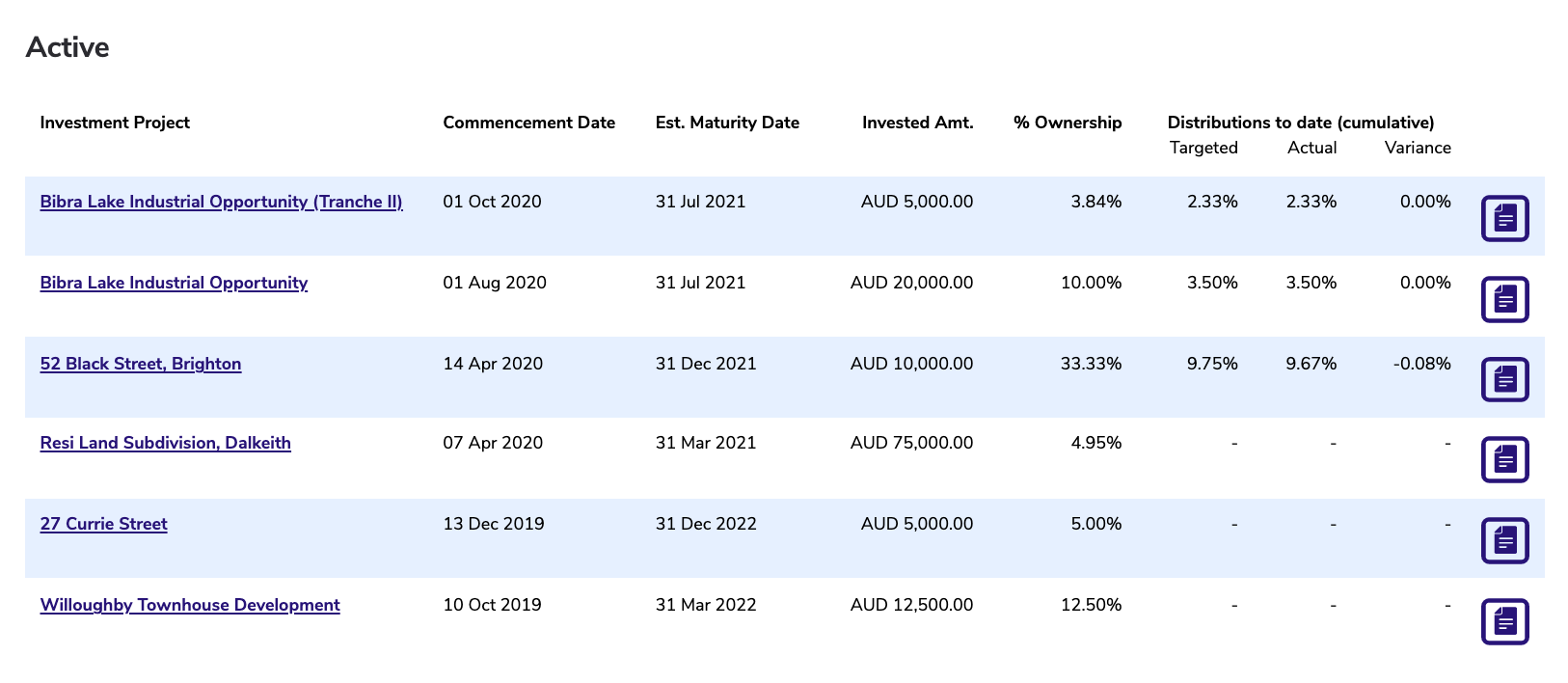

Example of diversified real estate investments within a single market

Conclusion

Diversification is an important way to reduce risk in an investment portfolio. Real estate allows investors to diversify their portfolio even within the asset class itself through a combination of different sectors, markets and strategies. However, diversifying your investment portfolio requires a certain degree of existing knowledge about the property market, and investors may need to consult with experienced real estate professionals before entering into an investment.

RealVantage is a co-investment platform managed by experienced real estate professionals. RealVantage allows investors to invest across the full real estate spectrum across geographies, strategies and property types. Investors may select the property they wish to invest with full transparency on the investment approach, and guided by the advice of real estate veterans.

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.