Blockchain in Real Estate Investment: Hope or Hype?

How will blockchain technology change real estate investments? Is it worth all the hope or hype in the real estate industry? Find out more!

Table of Contents

- Key Takeaways

- What it is and how it works?

- Benefits and common myths about the technology

a. Secure

b. Transparent

c. Trustless and disintermediation

d. Smart contracts - Real estate ripe for blockchain disruption?

- Challenges for blockchain

- Scale limitations

- Vested interests and cultural resistance

- Lack of regulatory infrastructure

- Taking stock and conclusion

Blockchain has been among the hottest buzzwords making the rounds in technology and business circles in recent times. As active real estate investors, we have been closely tracking developments in this space – specifically for applications to real estate investment.

As we delve into specifics, it is worthwhile to make a distinction between public and private blockchains. In this article, our discussions relate first and foremost to the former because this is the area where we think the potential for large-scale disruption is most promising (but also the section where blockchain concepts receive the most hype). Where appropriate, we draw references to private blockchains, noting that they currently make up the bulk of applications in the real estate domain.

Key Takeaways:

- Blockchain technology has the potential to dramatically change the real estate investment industry, resulting in significant cost and time savings, reduced friction during transactions, enhanced transparency and liquidity amongst the many benefits.

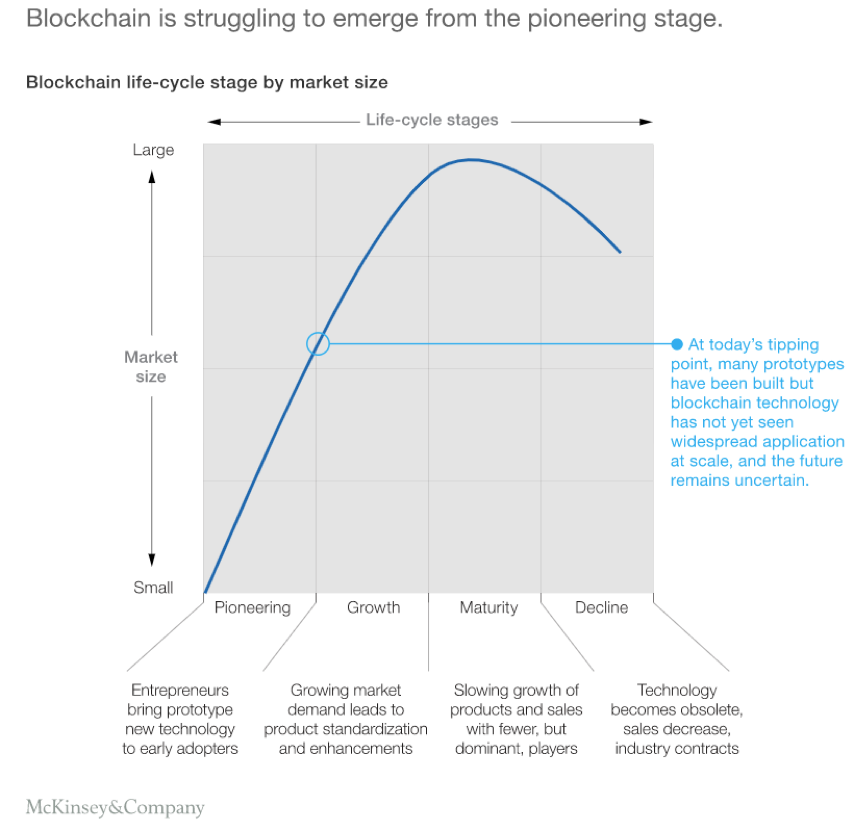

- Because of its disruption potential, immense amounts of capital have gone into developing the technology and testing new applications. Nevertheless, most of these endeavours remain in the pioneering stage and have yet to come close to becoming the game-changers some expected.

- On the technical front, the energy, computing speed and storage space required present hurdles that need to be overcome.

- On the human and cultural front, we can expect certain stakeholders within the real estate investment eco-system guided by vested interests to put up resistance to widespread collaboration, thereby preventing realisation of blockchain’s full potential.

- Importantly, the necessary regulatory infrastructure that is vital for blockchain to take off in a meaningful way remains too under-developed at the moment. This is not due to a lack of enthusiasm on the part of regulators, but rather, the inherent challenges of regulating what is essentially a decentralised system.

- In the foreseeable future, modest scale deployment of blockchain technology (on private blockchains) in relatively niche applications is the more likely scenario rather than any major overhaul to the real estate investment industry.

What it is and how it works?

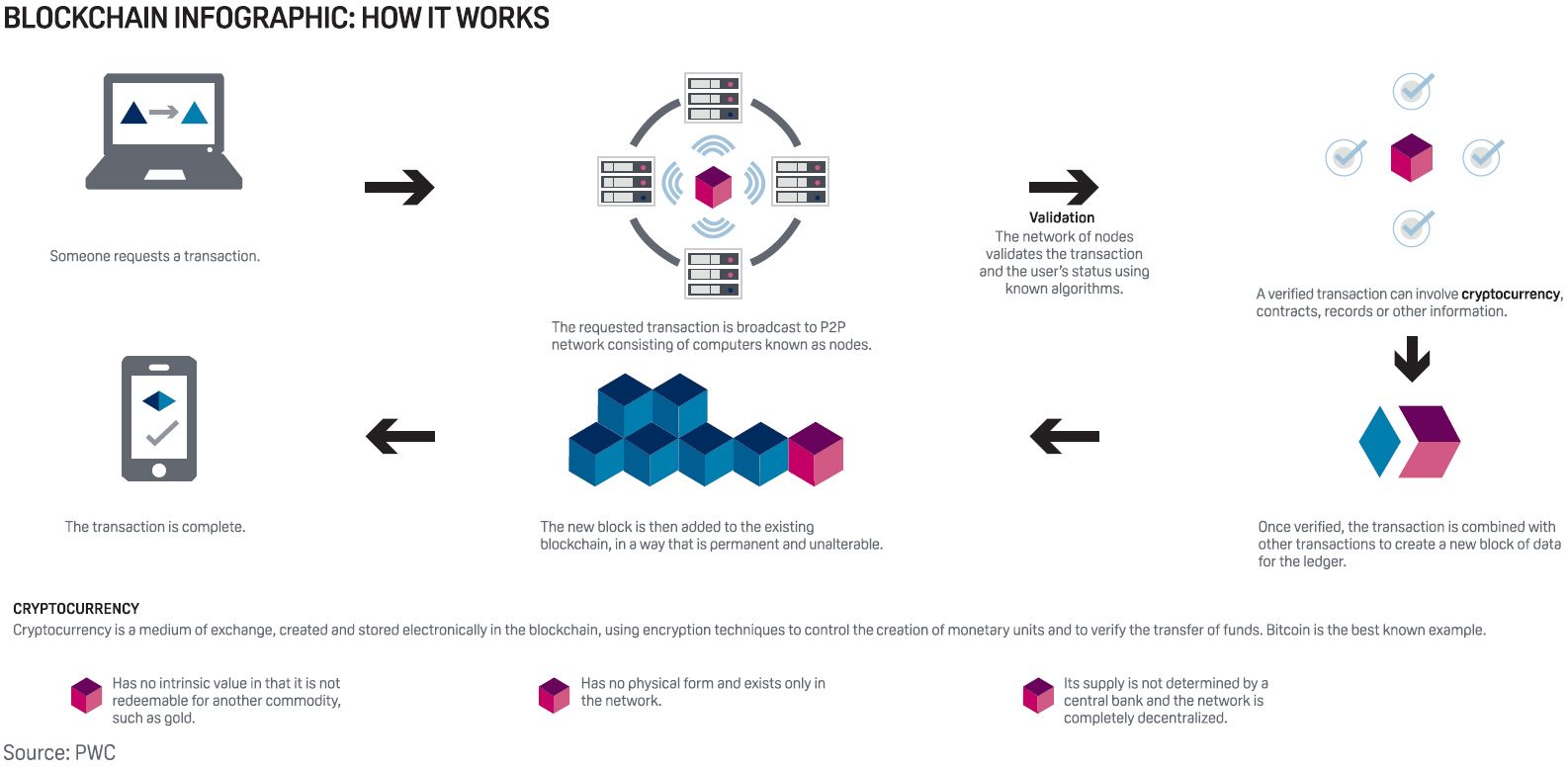

Before getting into how blockchain can be applied in real estate, it is important to understand what it is and how it works (Exhibit 1). Essentially, a blockchain is a time-stamped series of data record/database that is distributed across a network of computers known as “nodes” Blockchain is also commonly referred to as a distributed ledger in various literature.

Each “block” in the blockchain represents a transaction, which could be a property purchase or an update of an online record. Before a block is added, the transaction it represents must be verified. This is done by broadcasting the requested transaction to the network of nodes where known algorithms will validate the transaction. Once verified, details of the transaction are stored in a block which will be added to the blockchain after it is assigned a unique identifying code called a hash.

The main difference between a public and private blockchain is the level of access granted to participants. While public blockchains are completely decentralised, open and allow anyone to participate by verifying or adding data to the blockchain, the private versions (also known as “permissioned blockchain”) grant specific rights and restrictions to participants in the network. Accordingly, private blockchains are more centralised in nature since only a restricted group of participants control the network and database.

Sign Up at RealVantageBenefits and common myths about the technology

The unique architecture of the blockchain network gives rise to a number of benefits for the technology.

Secure

Every node on the network verifies the transaction and when approved, the block is added to the chain and becomes permanent and virtually impossible to alter due to the complex cryptography that underpins exchanges on the network. In a truly decentralised peer-to-peer network, every computer has its own copy of the blockchain. Spreading that information across a network makes the information difficult to manipulate. A hacker would need to manipulate every copy of the blockchain on the network. This is the feature that gives public blockchains the quality of “immutability”.

On the other hand, a private network is more vulnerable to risks of hacks and data manipulation. With fewer nodes, it is easier for a ‘bad actor’ to compromise the integrity of the network.

Transparent

Having the same records spread across a large network for all to see is the core of blockchain transparency. All transactions are viewable once a block is validated and added to the blockchain. Blockchain technology is said to be transparent in this respect.

However, it is important to distinguish between the public addresses and private identities of parties to a transaction. While the transactions and holdings of each public address are open to viewing, representing an unprecedented level of transparency in this area, the extent of transparency stops there. User identities are concealed behind powerful cryptography that makes linking public addresses to individual users particularly difficult to achieve.

Similar to the point on security, the number of participants and size of network bear an inverse relationship to the level of transparency that can be achieved, i.e. smaller network/restricted participants means lower level of transparency in private blockchains.

Trustless and disintermediation

The aforementioned features of security, decentralisation, privacy and transparency combine to offer the profound quality of trustlessness – a model that does not require trust to safely transact. The consensus algorithm utilised by all parties in the distributed system ensures that a transaction will only be validated when certain conditions such as transacting parties authenticity and currency validity have been satisfied. Transacting in such an environment where trust is not required renders (expensive) middle-men or third parties who traditionally served as a trusted entity to facilitate transactions irrelevant. This is an important attribute of public blockchains.

In the case of private blockchains, the integrity of the network still relies on the credibility of the authorised nodes. External parties have to trust the private network without having any form of control over the verification process.

Smart contracts

A key feature of blockchain technology, smart contracts are algorithms embedded within the blockchain that automatically execute once certain terms are met. This removes the notion of disputing contracts, a considerable amount of paperwork and can significantly improve efficiency.

While discussing the benefits, we should also be cognisant of certain misconceptions about the advantages and limitations surrounding the technology. As already mentioned, immutability of the blockchain is a function of how distributed/concentrated control of the network is. Even in applications where security is extremely high, as in the case of public blockchains, the overall blockchain system security depends on adjacent applications, which have been attacked and breached on occasions. Blockchains do not serve as “truth machines” either. While blockchains can verify transactions and data, they are not able to assess whether an external input is accurate or “truthful”.

Real estate ripe for blockchain disruption?

Amongst its many potential applications, real estate investment is an area where blockchain-based disruption seems promising because of the nature of typical property transactions.

Transactions often involve many parties. Beyond buyers and sellers, stakeholders often include governments, brokers, financiers, lawyers, valuers, accountants, tenants, operators etc. The multi-party interaction gets more complex for cross-border deals.

- Relatively high transaction costs, especially for deals involving middlemen, give strong motivation for disintermediation.

- Transactions often include conditional clauses. For example, the completion of a deal could be contingent on loan approvals or title clearances, an area where smart contracts can improve efficiency especially when it is linked to an automated payment interface.

- In some jurisdictions, it is not uncommon to have disparate real estate databases across government agencies and geographies. Depending on the efficiency levels of the jurisdictions, the traditional system can be prone to data inaccuracies. Due diligence can become onerous, time-consuming and costly.

- Compared to other investment asset classes, real estate transactions remain relatively less transparent. While details of ownership transfers and leases are captured somewhere within the traditional system (with tax authorities for example), they may not always be easily accessible.

- Real estate investment typically involves relatively large ticket sizes as well as round-trip investment cost, creating hurdles for some investors who are smaller or desire a higher level of liquidity. Digitised ownership on a blockchain platform could address these issues in theory by facilitating fractional ownership and liquidity.

Lining up the benefits of blockchain technology against the inherent nature of traditional real estate investing as we have just did, it is easy to see how there could be applications to address various existing pain points. The improvements in data integrity and accessibility, transparency, disintermediation, streamlined processes etc. combine to promise cost and time savings, better liquidity and reduced complexity in real estate transactions.

Read also: Application of Technology in Real Estate Investments

Challenges for blockchain

Moving the discussion from theory to the practical world, we make a few observations. While some governments and large companies have allocated resources to researching and studying the implications and applications of blockchain in real estate, we observed that it is often the startups that are eager to position their blockchain pursuits as would-be world changers. But to portray how blockchain would herald a new age of real estate investment with vastly improved security, transparency, efficiency and liquidity at higher speeds and lower costs remains a one-sided picture, in our opinion.

A number of significant hurdles stand in the way of the touted promises from this “revolution”.

Scale limitations

Core benefits of blockchain, including security guarantee, immutability and transparency come at the cost of scalability. In all public blockchain consensus protocols, every fully participating node in the network must process every transaction.

As a result, the speed and number of blockchains that can be processed is subject to the limitations of a single node. As more nodes are added, blockchains get less responsive due to latency issues. Due considerations should also be given to data storage and retrieval capacity as every node needs to maintain a copy of the growing blockchain. If blockchain real estate transactions do take off in a big way, new technological breakthroughs are required to prevent the network from becoming overly clunky that it is only feasible for a few nodes that can afford the computing resources.

Sign Up at RealVantageVested interests and cultural resistance

Given the intensive capital investments required to develop the technology, applications will need to demonstrate convincing at-scale value. As mentioned before, there are many parties to the real estate value chain. Meaningful collaborations amongst various stakeholders are likely required in order to achieve both commercial viability as well as requisite adoption of shared industry standards and data practices. Therein lies another significant hurdle where resistance from certain quarters could hinder the adoption scale of blockchain applications. In addition, not all parties view the “benefits” of real estate blockchain in the same way.

While transparency sounds like a good thing to many, the lack of it could be seen as a competitive edge for others, such as some landlords of multi-tenanted office assets. Cutting out brokers to save on fees seem desirable to investors on paper. Yet real estate is and will always remain very much a local business. Some investors are happy to pay fees and look to brokers as more than just middlemen for transactions. In many instances, the relationship runs deeper with brokers doubling up as local on-the-ground resource, especially for cross-border investors.

Read also: An Analysis of COVID-19’s Impact on Office Real Estate Demand

Lack of regulatory infrastructure

With real estate and finance being heavily regulated industries in just about every jurisdiction, sufficient regulatory framework would need to be in place for blockchain technology to meaningfully reshape the real estate investment industry. While some governments have been relatively open-minded and expressed a supportive stance, the progress so far has been modest.

For example, governments of various countries including India, Georgia, Sweden and Japan are exploring applying blockchain technology for property title registration systems. These are positive signs towards blockchain adoption but the regulatory infrastructure is still a long distance from what is required to enable the hyped up blockchain revolution.

Given the vast amounts of investment capital that FinTech and PropTech projects have been attracting, many governments are keen to provide a conducive environment for such initiatives to develop. But as is evident, regulators have been vigilantly cautious towards blockchain. In 2 white papers commissioned by the Hong Kong Monetary Authority (HKMA) in 2016 and 2017, the list of potential issues were wide ranging, including privacy, legal and compliance concerns, cyber security and laundering risks. The papers also observed that little had been done so far by other authorities to align blockchain with compliance and regulatory requirements.

On this last point, we believe it has more to do with the massive challenges inherent in exerting control over what is by nature a decentralised system rather than the lack of motivation.

The lack of regulatory infrastructure presents a significant hurdle to achieving enhanced secondary market liquidity of real estate assets via blockchain. Tokenisation – the act of representing assets in digital form on blockchains – of real estate might have been oversold as the solution to liquefying an otherwise illiquid asset class. After the creation and initial sale of tokens, there needs to be secondary trading platforms of sufficient scale to realise the liquidity potential.

Without adequate regulatory framework in place, individual trading platforms and exchanges are not able to develop to the extent of enabling any meaningful liquidity and will likely remain as fragmented islands. Reflective of regulators’ cautious attitudes, the Financial Stability Board – an international body that monitors and makes recommendations about the global financial system – issued a report earlier this year warning that tokenised liquidity could be illusory.

Taking stock and conclusion

Twenty-eight years since it was first proposed as a research project and eleven years since it was launched, blockchain has attracted immense investment capital. Despite strong belief in the technology’s enormous potential, doubts are also emerging. Given the amount of money and time invested, the pace of progress has been described by McKinsey as “disappointing”. Indeed, blockchain-based projects have raised upwards of USD 21 billion in 2018 alone, according to data from CoinSchedule.

Of the many use cases, a large number are still at the idea stage while others are in development with no output (Exhibit 2). The management consultancy further noted that there is no guarantee that blockchain will progress beyond the “pioneering stage” in the industry lifecycle.

Read also: The Real Estate Cycle

While there is a sense of the technology’s game-changing potential in the field of real estate investment, the impediments to realising them are substantial to say the least. More than just the efforts of a handful of enterprising and innovative players, structural changes and concerted collaboration within the ecosystem (including regulators) as well as technological advancements to address aforementioned technical issues are required.

In the foreseeable future, modest scale deployment of blockchain technology in relatively niche applications (land registry systems for example) is the more likely scenario rather than any major overhaul to the real estate investment industry. Private blockchain applications championed by smaller parties as part of a larger solution is also likely to gain grounds on the fringe, although some initiatives might risk becoming isolated islands rather than being part of a larger network. Taking stock of all the good (potential benefits), the bad (challenges) and the ugly (situation to-date), we will remain grounded but ever watchful and hopeful of further blockchain developments for real estate investors.

For more insights:

About RealVantage

RealVantage is a leading real estate co-investment platform, licensed and regulated by the Monetary Authority of Singapore (MAS), that allows our investors to diversify across markets, overseas properties, sectors and investment strategies.

The team at RealVantage are highly qualified professionals who brings about a multi-disciplinary vision and approach in their respective fields towards business development, management, and client satisfaction. The team is led by distinguished Board of Advisors and advisory committee who provide cross-functional and multi-disciplinary expertise to the RealVantage team ranging from real estate, corporate finance, technology, venture capital, and startups growth. The team's philosophy, core values, and technological edge help clients build a diversified and high-performing real estate investment portfolio.

Get in touch with RealVantage today to see how they can help you in your real estate investment journey.

Disclaimer: The information and/or documents contained in this article does not constitute financial advice and is meant for educational purposes. Please consult your financial advisor, accountant, and/or attorney before proceeding with any financial/real estate investments.